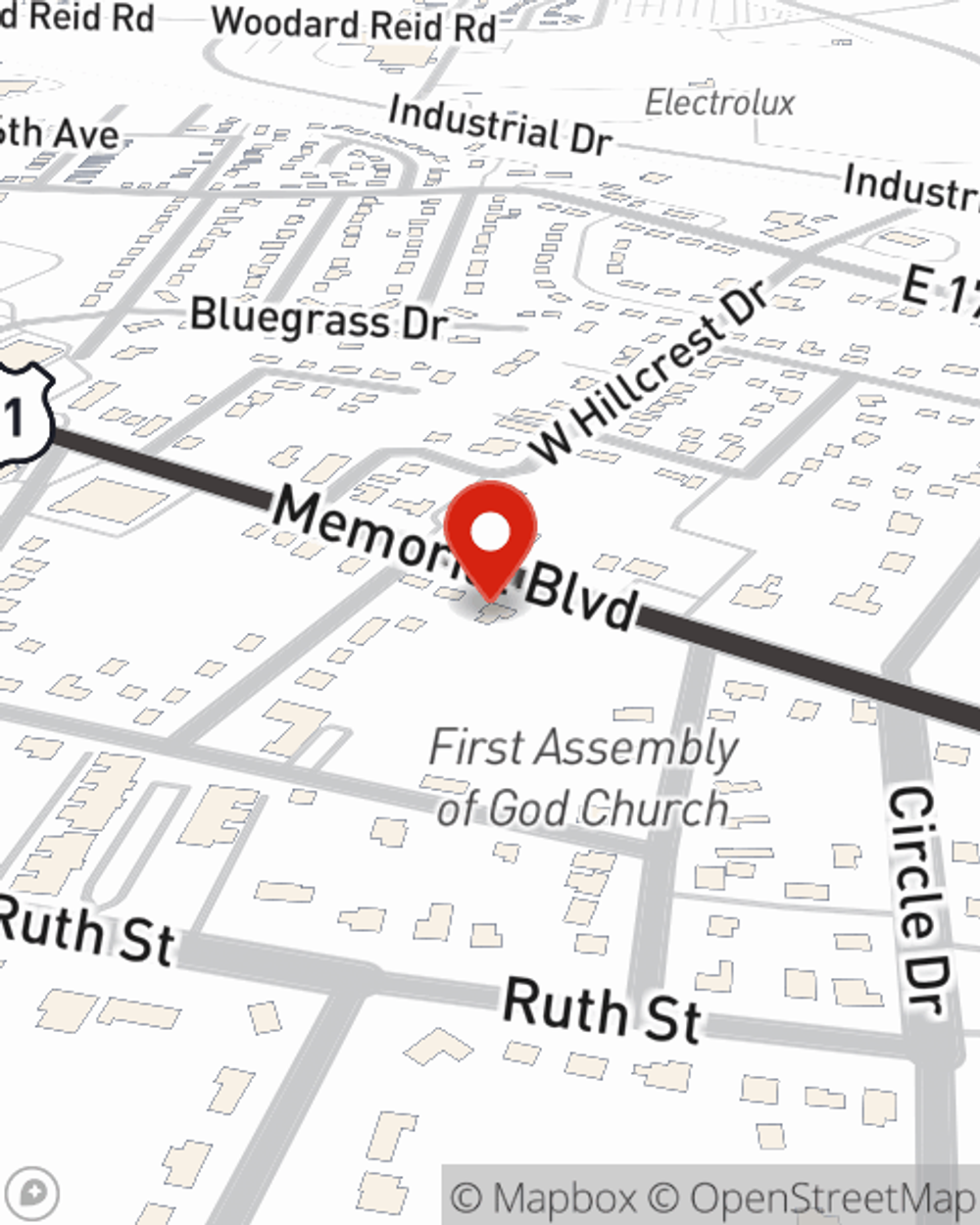

Condo Insurance in and around Springfield

Springfield! Look no further for condo insurance

Condo insurance that helps you check all the boxes

- Springfield

- Greenbrier

- Goodlettsville

- Nashville

- Madison

- Ridgetop

- Joelton

- Coopertown

- Pleasant View

- Ashland City

- Clarksville

- Cross Plains

- Adams

- White House

- Orlinda

- Cedar Hill

- Davidson County

- Montgomery County

- Sumner County

- Robertson County

- Rutherford County

- Wilson County

- Williamson County

- Cheatham County

Condo Sweet Condo Starts With State Farm

Stepping into condo ownership is a big responsibility. You need to consider neighborhood cosmetic fixes and more. But once you find the perfect condo to call home, you also need fantastic insurance. Finding the right coverage can help your Springfield unit be a sweet place to call home!

Springfield! Look no further for condo insurance

Condo insurance that helps you check all the boxes

Why Condo Owners In Springfield Choose State Farm

You’ll get that and more with State Farm Condo Unitowners Insurance. State Farm has plenty options to keep your most personal possessions protected. You’ll get coverage options to accommodate your specific needs. Luckily you won’t have to figure that out by yourself. With personal attention and terrific customer service, Agent Beth Null Dorris can walk you through every step to help set you up with a plan that covers your condo unit and everything you’ve invested in.

Finding the right protection for your unit is made painless with State Farm. There is no better time than today to visit agent Beth Null Dorris and discover more about your fantastic options.

Have More Questions About Condo Unitowners Insurance?

Call Beth Null at (615) 384-0022 or visit our FAQ page.

Simple Insights®

Power outage preparedness tips

Power outage preparedness tips

Learn some power outage preparedness tips, including what do before, during and after it happens.

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.

Beth Null Dorris

State Farm® Insurance AgentSimple Insights®

Power outage preparedness tips

Power outage preparedness tips

Learn some power outage preparedness tips, including what do before, during and after it happens.

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.